Since the 2020 elections, there has been great consternation over potential changes in Federal tax law. As we near 2022, the debate over extending or making permanent the increases in Federal spending resulting from the “American Rescue Plan Act” (ARP) and tax policies to fund the spending will grow louder in Washington. In this article, we discuss the most impactful elements of President Biden’s proposed “American Families Plan” (AFP) and the “American Jobs Plan” (AJP); the likelihood of these elements being passed into law; what proactive measures individuals might make in 2021; what strategies might be deployed by individuals in the future; and how potential policy changes might impact forward capital market expectations.

What are the most impactful elements of the AFP and AJP?

The AFP proposes that the highest marginal income tax rate increase from 37% to 39.6%. When including the “Net Investment Income Tax or Medicare Surtax” of 3.8%, the highest total income tax rate would be 43.4%. Not only is the marginal tax rate higher, individuals and couples will hit the higher bracket at lower income thresholds ($452,700 per individual and $509,300 per couple vs. $523,600 per individual and $628,300 per couple today). Under the AFP, high income earners would no longer enjoy favorable tax treatment on long-term capital gains and qualified dividends as they would be taxed as ordinary income for individuals with incomes over $1 million resulting in a top marginal rate of 43.4% vs. the current highest long-term capital gains and qualified dividends rate of 23.8%. Potentially uprooting decades of existing tax law, the AFP seeks to eliminate the step-up-in-basis on unrealized capital gains at death for gains exceeding $1 million for individuals and $2.5 million for married couples. The AJP proposes that corporate tax rates be increased from 21% to 28% and the elimination of like-kind exchanges in excess of $500,000.

How likely are these potential changes to be passed into law?

Handicapping potential changes to Federal tax law is challenging given the narrow majorities held in Congress by the Democratic party, wide-ranging opinions within the Democratic party itself and the looming 2022 mid-term elections. Additionally, the complex interplay between a potential bipartisan infrastructure package and a partisan reconciliation package further fuels uncertainty as to the final outcomes. However, the proposed changes discussed previously regarding higher income taxes on high income earners will likely garner a fair amount of support given the tenor of the day. The magnitude of the changes proposed regarding the treatment of long-term capital gains and qualified dividends will likely be tempered but may nonetheless still result in a considerable increase. The changes in the step-up-in-basis would represent a dramatic change and would impact many American families. Additionally, the added complexity would require significant work for individuals, their tax advisors and the IRS. Perhaps final legislation regarding the step-up-in-basis will be enacted with very high exemptions. While higher corporate taxes appear to have a good bit of support, the proposed 28% rate remains lower than the 35% tax rate corporations faced until the passage of the “Tax Cut and Jobs Act” in 2017.

What might I do in 2021 ahead of potential changes?

For high income earners, consider accelerating income into 2021 and utilize devices such as deferred compensation arrangements, 401(k)s, IRAs, HSAs, etc. to reduce taxable income in future. We firmly believe that investment considerations, namely risk management, outweigh tax considerations. To the extent you have concentrated investments with long-term capital gains or have near term liquidity needs, consider accelerating plans for reducing exposure in 2021. When utilizing Trusts, consider provisions that allow for assets swapped between the Grantor and the Trusts to provide flexibility to optimally navigate potential changes in current step-up-in-basis rules. While the AFP does not contemplate changes to the current transfer tax regime (estate, gift and generation skipping taxes) there are other Senate bills that do. Bottom line, the current law is very favorable for families with transfer tax exposure.The existing gift and estate tax exemption amount of $11.7 million per person expires under current law at the end of 2025 and returns to approximately $6 million per person. We believe time is of the essence for tax efficient multi-generational wealth transfer. Many well-established techniques for gifting discounted assets and reducing taxable estates through Grantor Retained Annuity Trusts and Intentionally Defective Grantor Trusts will likely remain under attack. Again, time is of the essence for advanced planning.

What are the structural elements I need to maximize my “take home” returns for my investments?

Maximizing after-tax returns while assuming an appropriate level of risk consistent with your unique goals has and will remain a structural feature of a Truxton designed and managed portfolio. Many of Truxton’s standing processes for tax efficiency will simply become more important should the proposals become law. In contrast to pooled investment vehicles (Mutual Funds, Common Trust Funds, etc.) used by retail investors, owning a good number of tax lots in individual stocks, bonds and Exchange Traded Funds allows your Portfolio Manager to 100% control the timing of realizing capital gains. Should there be disparate treatment for capital gains for high income earners in the future, the need for very exacting timing on capital gains will be even more critical. A Truxton managed portfolio incorporates an intentional tax loss harvesting process to capture capital losses to offset realized gains now and into the future. This process can meaningfully improve your “take home” returns. Since Truxton buys high-quality investments with the intent to hold them for an extended time period, our portfolio turnover is typically low, thereby limiting capital gains tax exposure. Other ways to improve tax efficiency may include the use of tax-exempt municipal bonds and intelligent asset placement between taxable and tax-exempt accounts.

How might the proposed changes impact forward capital market expectations?

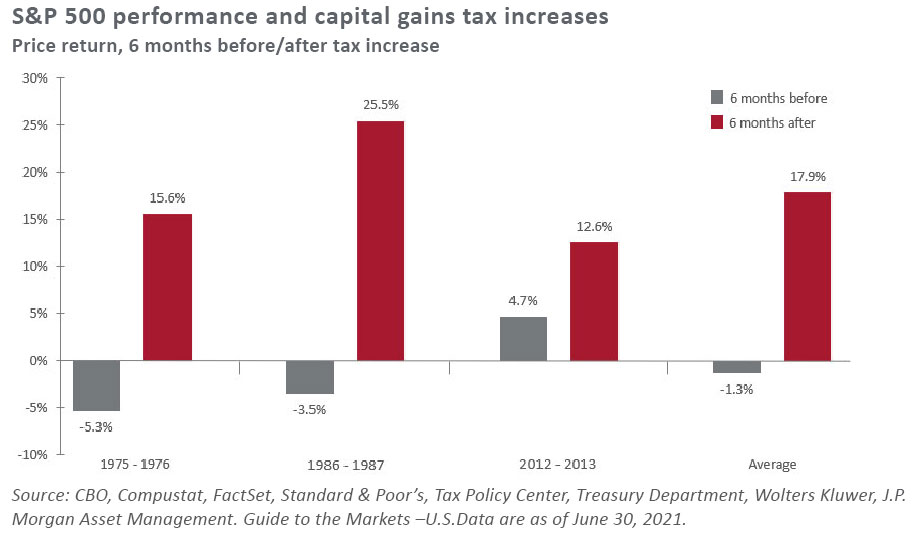

At Truxton, we take the long view. This means we think in decades vs. days, months and quarters. Admittedly, this long perspective requires a great deal of discipline, fortitude, ample real-world experience and patience as we battle the anxieties resulting from the constant noise of the ticker tape and financial media. Despite potential tax changes, we continue to believe we can responsibly compound our clients’ wealth at attractive rates of return over a long period of time. Interestingly, equity markets have historically fared well following tax increases as they have typically been accompanied by stimulative spending by the Federal government. The environment remains fluid and we remain vigilant on managing portfolio risk and pursuing tactical investment opportunities to enhance returns. While the surprisingly strong run in equities may have pulled some returns forward lowering future return expectations, we believe solid investment opportunities remain for the disciplined investor. Taking action now to reduce the tax bite will enhance investment outcomes.

As you might imagine, optimizing an individual’s tax situation requires thorough analysis, defining long-term plans and exacting year over year execution. There are many tools at our disposal to help manage after-tax results. The utilization of these tools will vary based on your unique facts and circumstances. Today represents a unique time to get better organized and structured and consider advanced planning opportunities. If you happen to live in a state with increasingly punitive income tax regimes like California and New York, the concepts in this article are even more important. We look forward to the conversation.

Since the 2020 elections, there has been great consternation over potential changes in Federal tax law. As we near 2022, the debate over extending or making permanent the increases in Federal spending resulting from the “American Rescue Plan Act” (ARP) and tax policies to fund the spending will grow louder in Washington. In this article, we discuss the most impactful elements of President Biden’s proposed “American Families Plan” (AFP) and the “American Jobs Plan” (AJP); the likelihood of these elements being passed into law; what proactive measures individuals might make in 2021; what strategies might be deployed by individuals in the future; and how potential policy changes might impact forward capital market expectations.

What are the most impactful elements of the AFP and AJP?

The AFP proposes that the highest marginal income tax rate increase from 37% to 39.6%. When including the “Net Investment Income Tax or Medicare Surtax” of 3.8%, the highest total income tax rate would be 43.4%. Not only is the marginal tax rate higher, individuals and couples will hit the higher bracket at lower income thresholds ($452,700 per individual and $509,300 per couple vs. $523,600 per individual and $628,300 per couple today). Under the AFP, high income earners would no longer enjoy favorable tax treatment on long-term capital gains and qualified dividends as they would be taxed as ordinary income for individuals with incomes over $1 million resulting in a top marginal rate of 43.4% vs. the current highest long-term capital gains and qualified dividends rate of 23.8%. Potentially uprooting decades of existing tax law, the AFP seeks to eliminate the step-up-in-basis on unrealized capital gains at death for gains exceeding $1 million for individuals and $2.5 million for married couples. The AJP proposes that corporate tax rates be increased from 21% to 28% and the elimination of like-kind exchanges in excess of $500,000.

How likely are these potential changes to be passed into law?

Handicapping potential changes to Federal tax law is challenging given the narrow majorities held in Congress by the Democratic party, wide-ranging opinions within the Democratic party itself and the looming 2022 mid-term elections. Additionally, the complex interplay between a potential bipartisan infrastructure package and a partisan reconciliation package further fuels uncertainty as to the final outcomes. However, the proposed changes discussed previously regarding higher income taxes on high income earners will likely garner a fair amount of support given the tenor of the day. The magnitude of the changes proposed regarding the treatment of long-term capital gains and qualified dividends will likely be tempered but may nonetheless still result in a considerable increase. The changes in the step-up-in-basis would represent a dramatic change and would impact many American families. Additionally, the added complexity would require significant work for individuals, their tax advisors and the IRS. Perhaps final legislation regarding the step-up-in-basis will be enacted with very high exemptions. While higher corporate taxes appear to have a good bit of support, the proposed 28% rate remains lower than the 35% tax rate corporations faced until the passage of the “Tax Cut and Jobs Act” in 2017.

What might I do in 2021 ahead of potential changes?

For high income earners, consider accelerating income into 2021 and utilize devices such as deferred compensation arrangements, 401(k)s, IRAs, HSAs, etc. to reduce taxable income in future. We firmly believe that investment considerations, namely risk management, outweigh tax considerations. To the extent you have concentrated investments with long-term capital gains or have near term liquidity needs, consider accelerating plans for reducing exposure in 2021. When utilizing Trusts, consider provisions that allow for assets swapped between the Grantor and the Trusts to provide flexibility to optimally navigate potential changes in current step-up-in-basis rules. While the AFP does not contemplate changes to the current transfer tax regime (estate, gift and generation skipping taxes) there are other Senate bills that do. Bottom line, the current law is very favorable for families with transfer tax exposure.The existing gift and estate tax exemption amount of $11.7 million per person expires under current law at the end of 2025 and returns to approximately $6 million per person. We believe time is of the essence for tax efficient multi-generational wealth transfer. Many well-established techniques for gifting discounted assets and reducing taxable estates through Grantor Retained Annuity Trusts and Intentionally Defective Grantor Trusts will likely remain under attack. Again, time is of the essence for advanced planning.

What are the structural elements I need to maximize my “take home” returns for my investments?

Maximizing after-tax returns while assuming an appropriate level of risk consistent with your unique goals has and will remain a structural feature of a Truxton designed and managed portfolio. Many of Truxton’s standing processes for tax efficiency will simply become more important should the proposals become law. In contrast to pooled investment vehicles (Mutual Funds, Common Trust Funds, etc.) used by retail investors, owning a good number of tax lots in individual stocks, bonds and Exchange Traded Funds allows your Portfolio Manager to 100% control the timing of realizing capital gains. Should there be disparate treatment for capital gains for high income earners in the future, the need for very exacting timing on capital gains will be even more critical. A Truxton managed portfolio incorporates an intentional tax loss harvesting process to capture capital losses to offset realized gains now and into the future. This process can meaningfully improve your “take home” returns. Since Truxton buys high-quality investments with the intent to hold them for an extended time period, our portfolio turnover is typically low, thereby limiting capital gains tax exposure. Other ways to improve tax efficiency may include the use of tax-exempt municipal bonds and intelligent asset placement between taxable and tax-exempt accounts.

How might the proposed changes impact forward capital market expectations?

At Truxton, we take the long view. This means we think in decades vs. days, months and quarters. Admittedly, this long perspective requires a great deal of discipline, fortitude, ample real-world experience and patience as we battle the anxieties resulting from the constant noise of the ticker tape and financial media. Despite potential tax changes, we continue to believe we can responsibly compound our clients’ wealth at attractive rates of return over a long period of time. Interestingly, equity markets have historically fared well following tax increases as they have typically been accompanied by stimulative spending by the Federal government. The environment remains fluid and we remain vigilant on managing portfolio risk and pursuing tactical investment opportunities to enhance returns. While the surprisingly strong run in equities may have pulled some returns forward lowering future return expectations, we believe solid investment opportunities remain for the disciplined investor. Taking action now to reduce the tax bite will enhance investment outcomes.

As you might imagine, optimizing an individual’s tax situation requires thorough analysis, defining long-term plans and exacting year over year execution. There are many tools at our disposal to help manage after-tax results. The utilization of these tools will vary based on your unique facts and circumstances. Today represents a unique time to get better organized and structured and consider advanced planning opportunities. If you happen to live in a state with increasingly punitive income tax regimes like California and New York, the concepts in this article are even more important. We look forward to the conversation.